Page 17 - Work Force October 2019

P. 17

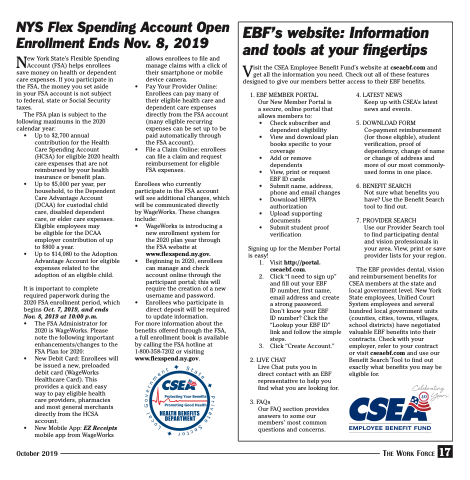

NYS Flex Spending Account Open Enrollment Ends Nov. 8, 2019

EBF’s website: Information and tools at your fingertips

Visit the CSEA Employee Benefit Fund’s website at cseaebf.com and get all the information you need. Check out all of these features designed to give our members better access to their EBF benefits.

1. EBF MEMBER PORTAL

Our New Member Portal is a secure, online portal that allows members to:

4. LATEST NEWS

Keep up with CSEA’s latest news and events.

5. DOWNLOAD FORM Co-payment reimbursement (for those eligible), student verification, proof of dependency, change of name or change of address and more of our most commonly- used forms in one place.

6. BENEFIT SEARCH

Not sure what benefits you have? Use the Benefit Search tool to find out.

7. PROVIDER SEARCH

Use our Provider Search tool to find participating dental and vision professionals in your area. View, print or save provider lists for your region.

The EBF provides dental, vision and reimbursement benefits for CSEA members at the state and local government level. New York State employees, Unified Court System employees and several hundred local government units (counties, cities, towns, villages, school districts) have negotiated valuable EBF benefits into their contracts. Check with your employer, refer to your contract or visit cseaebf.com and use our Benefit Search Tool to find out exactly what benefits you may be eligible for.

• •

• • • • • •

Signing is easy!

1. 2.

3.

Check subscriber and dependent eligibility View and download plan books specific to your coverage

Add or remove dependents

View, print or request EBF ID cards

Submit name, address, phone and email changes Download HIPPA authorization

Upload supporting documents

Submit student proof verification

up for the Member Portal

Visit http://portal. cseaebf.com.

Click “I need to sign up” and fill out your EBF

ID number, first name, email address and create a strong password.

Don’t know your EBF

ID number? Click the “Lookup your EBF ID” link and follow the simple steps.

Click “Create Account.”

2. LIVE CHAT

Live Chat puts you in

direct contact with an EBF representative to help you find what you are looking for.

3. FAQs

Our FAQ section provides answers to some our members’ most common questions and concerns.

New York State’s Flexible Spending Account (FSA) helps enrollees save money on health or dependent care expenses. If you participate in the FSA, the money you set aside

in your FSA account is not subject

to federal, state or Social Security taxes.

The FSA plan is subject to the following maximums in the 2020 calendar year:

• Up to $2,700 annual contribution for the Health Care Spending Account (HCSA) for eligible 2020 health care expenses that are not reimbursed by your health insurance or benefit plan.

• Up to $5,000 per year, per household, to the Dependent Care Advantage Account (DCAA) for custodial child care, disabled dependent care, or elder care expenses. Eligible employees may

be eligible for the DCAA employer contribution of up to $800 a year.

• Up to $14,080 to the Adoption Advantage Account for eligible expenses related to the adoption of an eligible child.

It is important to complete required paperwork during the 2020 FSA enrollment period, which begins Oct. 7, 2019, and ends Nov. 8, 2019 at 10:00 p.m.

• The FSA Administrator for

2020 is WageWorks. Please note the following important enhancements/changes to the FSA Plan for 2020:

• New Debit Card: Enrollees will be issued a new, preloaded debit card (WageWorks Healthcare Card). This provides a quick and easy way to pay eligible health care providers, pharmacies and most general merchants directly from the HCSA account.

• New Mobile App: EZ Receipts mobile app from WageWorks

allows enrollees to file and manage claims with a click of their smartphone or mobile device camera.

• Pay Your Provider Online: Enrollees can pay many of their eligible health care and dependent care expenses directly from the FSA account (many eligible recurring expenses can be set up to be paid automatically through the FSA account).

• File a Claim Online: enrollees can file a claim and request reimbursement for eligible FSA expenses.

Enrollees who currently participate in the FSA account will see additional changes, which will be communicated directly

by WageWorks. These changes include:

• WageWorks is introducing a

new enrollment system for the 2020 plan year through the FSA website at www.flexspend.ny.gov.

• Beginning in 2020, enrollees can manage and check account online through the participant portal; this will require the creation of a new username and password.

• Enrollees who participate in direct deposit will be required to update information.

For more information about the benefits offered through the FSA, a full enrollment book is available by calling the FSA hotline at 1-800-358-7202 or visiting www.flexspend.ny.gov.

October 2019

The Work Force 17