Page 17 - Work Force April 2016

P. 17

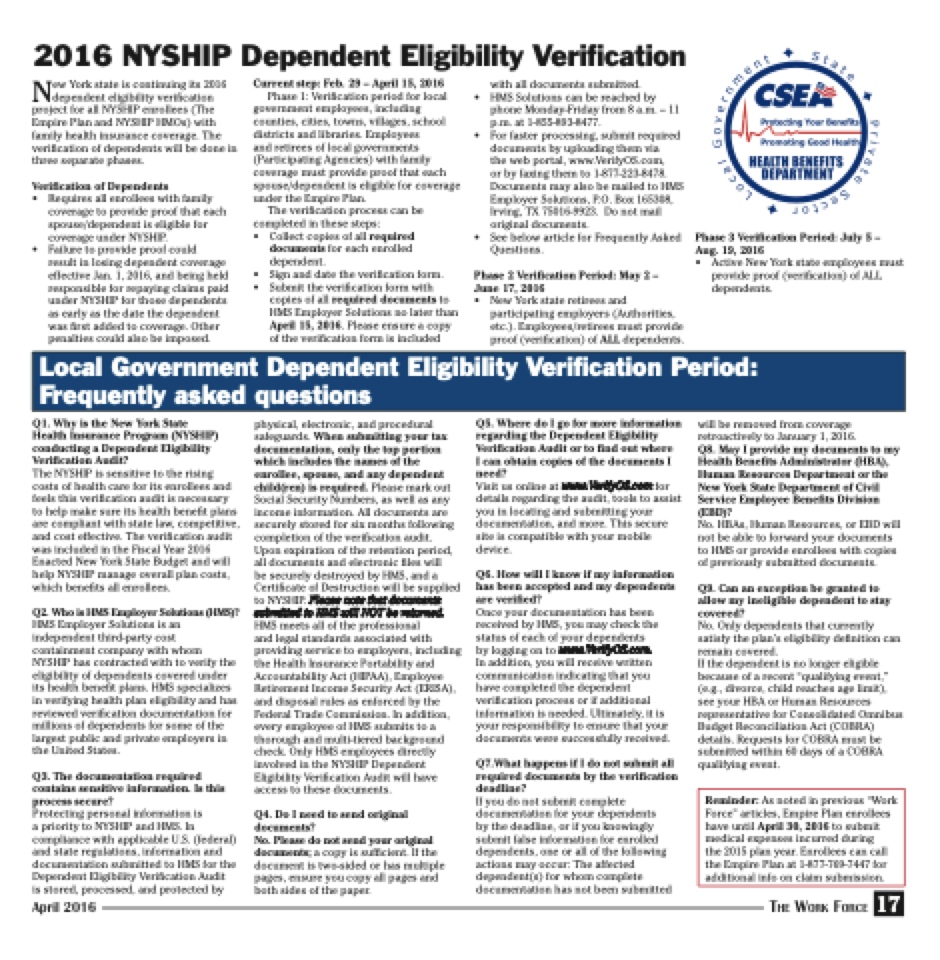

2016 NYSHIP Dependent Eligibility Verification

New York state is continuing its 2016 dependent eligibility verification project for all NYSHIP enrollees (The Empire Plan and NYSHIP HMOs) with family health insurance coverage. The verification of dependents will be done in three separate phases.

Verification of Dependents

• Requires all enrollees with family coverage to provide proof that each spouse/dependent is eligible for coverage under NYSHIP.

• Failure to provide proof could

result in losing dependent coverage effective Jan. 1, 2016, and being held responsible for repaying claims paid under NYSHIP for those dependents as early as the date the dependent was first added to coverage. Other penalties could also be imposed.

Q1. Why is the New York State

Health Insurance Program (NYSHIP) conducting a Dependent Eligibility Verification Audit?

The NYSHIP is sensitive to the rising costs of health care for its enrollees and feels this verification audit is necessary to help make sure its health benefit plans are compliant with state law, competitive, and cost effective. The verification audit was included in the Fiscal Year 2016 Enacted New York State Budget and will help NYSHIP manage overall plan costs, which benefits all enrollees.

Q2. Who is HMS Employer Solutions (HMS)?

HMS Employer Solutions is an independent third-party cost containment company with whom NYSHIP has contracted with to verify the eligibility of dependents covered under its health benefit plans. HMS specializes in verifying health plan eligibility and has reviewed verification documentation for millions of dependents for some of the largest public and private employers in the United States.

Q3. The documentation required contains sensitive information. Is this process secure?

Protecting personal information is

a priority to NYSHIP and HMS. In compliance with applicable U.S. (federal) and state regulations, information and documentation submitted to HMS for the Dependent Eligibility Verification Audit

is stored, processed, and protected by

April 2016

Current step: Feb. 29 – April 15, 2016

Phase 1: Verification period for local government employees, including counties, cities, towns, villages, school districts and libraries. Employees

and retirees of local governments (Participating Agencies) with family coverage must provide proof that each spouse/dependent is eligible for coverage under the Empire Plan.

The verification process can be completed in these steps:

• Collect copies of all required

documents for each enrolled

dependent.

• Sign and date the verification form. • Submit the verification form with

copies of all required documents to HMS Employer Solutions no later than April 15, 2016. Please ensure a copy of the verification form is included

physical, electronic, and procedural safeguards. When submitting your tax documentation, only the top portion which includes the names of the enrollee, spouse, and any dependent child(ren) is required. Please mark out Social Security Numbers, as well as any income information. All documents are securely stored for six months following completion of the verification audit. Upon expiration of the retention period, all documents and electronic files will

be securely destroyed by HMS, and a Certificate of Destruction will be supplied to NYSHIP. Please note that documents submitted to HMS will NOT be returned. HMS meets all of the professional

and legal standards associated with providing service to employers, including the Health Insurance Portability and Accountability Act (HIPAA), Employee Retirement Income Security Act (ERISA), and disposal rules as enforced by the Federal Trade Commission. In addition, every employee of HMS submits to a thorough and multi-tiered background check. Only HMS employees directly involved in the NYSHIP Dependent Eligibility Verification Audit will have access to these documents.

Q4. Do I need to send original documents?

No. Please do not send your original documents; a copy is sufficient. If the document is two-sided or has multiple pages, ensure you copy all pages and both sides of the paper.

with all documents submitted.

• HMS Solutions can be reached by

phone Monday-Friday from 8 a.m. – 11

p.m. at 1-855-893-8477.

• For faster processing, submit required

documents by uploading them via

the web portal, www.VerifyOS.com,

or by faxing them to 1-877-223-8478. Documents may also be mailed to HMS Employer Solutions, P.O. Box 165308, Irving, TX 75016-9923. Do not mail original documents.

• See below article for Frequently Asked Questions.

Phase 2 Verification Period: May 2 – June 17, 2016

• New York state retirees and

participating employers (Authorities, etc.). Employees/retirees must provide proof (verification) of ALL dependents.

Q5. Where do I go for more information regarding the Dependent Eligibility Verification Audit or to find out where

I can obtain copies of the documents I need?

Visit us online at www.VerifyOS.com for details regarding the audit, tools to assist you in locating and submitting your documentation, and more. This secure site is compatible with your mobile device.

Q6. How will I know if my information has been accepted and my dependents are verified?

Once your documentation has been received by HMS, you may check the status of each of your dependents

by logging on to www.VerifyOS.com.

In addition, you will receive written communication indicating that you have completed the dependent verification process or if additional information is needed. Ultimately, it is your responsibility to ensure that your documents were successfully received.

Q7.What happens if I do not submit all required documents by the verification deadline?

If you do not submit complete documentation for your dependents

by the deadline, or if you knowingly submit false information for enrolled dependents, one or all of the following actions may occur: The affected dependent(s) for whom complete documentation has not been submitted

Phase 3 Verification Period: July 5 – Aug. 19, 2016

• Active New York state employees must

provide proof (verification) of ALL dependents.

will be removed from coverage retroactively to January 1, 2016.

Q8. May I provide my documents to my Health Benefits Administrator (HBA), Human Resources Department or the New York State Department of Civil Service Employee Benefits Division (EBD)?

No. HBAs, Human Resources, or EBD will not be able to forward your documents to HMS or provide enrollees with copies of previously submitted documents.

Q9. Can an exception be granted to allow my ineligible dependent to stay covered?

No. Only dependents that currently satisfy the plan’s eligibility definition can remain covered.

If the dependent is no longer eligible because of a recent “qualifying event,” (e.g., divorce, child reaches age limit), see your HBA or Human Resources representative for Consolidated Omnibus Budget Reconciliation Act (COBRA) details. Requests for COBRA must be submitted within 60 days of a COBRA qualifying event.

Local Government Dependent Eligibility Verification Period: Frequently asked questions

Reminder: As noted in previous “Work Force” articles, Empire Plan enrollees have until April 30, 2016 to submit medical expenses incurred during

the 2015 plan year. Enrollees can call the Empire Plan at 1-877-769-7447 for additional info on claim submission.

The Work Force

17