Page 18 - Work Force July-August 2020

P. 18

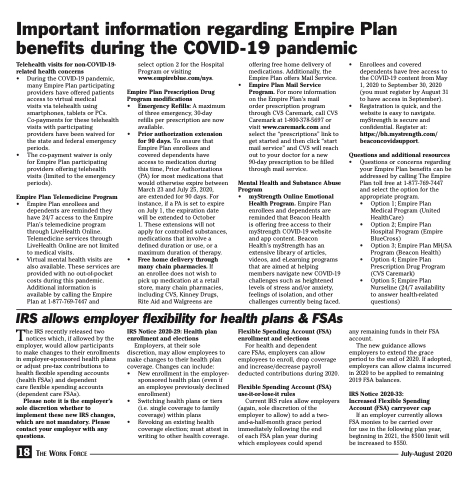

Important information regarding Empire Plan benefits during the COVID-19 pandemic

Telehealth visits for non-COVID-19- related health concerns

• During the COVID-19 pandemic,

many Empire Plan participating providers have offered patients access to virtual medical

visits via telehealth using smartphones, tablets or PCs. Co-payments for these telehealth visits with participating providers have been waived for the state and federal emergency periods.

• The co-payment waiver is only for Empire Plan participating providers offering telehealth visits (limited to the emergency periods).

Empire Plan Telemedicine Program

• Empire Plan enrollees and dependents are reminded they have 24/7 access to the Empire Plan’s telemedicine program through LiveHealth Online. Telemedicine services through LiveHealth Online are not limited to medical visits.

• Virtual mental health visits are also available. These services are provided with no out-of-pocket costs during this pandemic. Additional information is available by calling the Empire Plan at 1-877-769-7447 and

select option 2 for the Hospital Program or visiting www.empireblue.com/nys.

Empire Plan Prescription Drug Program modifications

• Emergency Refills: A maximum

of three emergency, 30-day refills per prescription are now available.

• Prior authorization extension for 90 days. To ensure that Empire Plan enrollees and covered dependents have access to medication during

this time, Prior Authorizations (PA) for most medications that would otherwise expire between March 23 and July 25, 2020,

are extended for 90 days. For instance, if a PA is set to expire on July 1, the expiration date will be extended to October

1. These extensions will not apply for controlled substances, medications that involve a defined duration or use, or a maximum duration of therapy.

• Free home delivery through many chain pharmacies. If

an enrollee does not wish to pick up medication at a retail store, many chain pharmacies, including CVS, Kinney Drugs, Rite Aid and Walgreens are

•

offering free home delivery of medications. Additionally, the Empire Plan offers Mail Service. Empire Plan Mail Service Program. For more information on the Empire Plan’s mail

order prescription program through CVS Caremark, call CVS Caremark at 1-800-378-5697 or visit www.caremark.com and select the “prescriptions” link to get started and then click “start mail service” and CVS will reach out to your doctor for a new 90-day prescription to be filled through mail service.

• Enrollees and covered dependents have free access to the COVID-19 content from May 1, 2020 to September 30, 2020 (you must register by August 31 to have access in September).

• Registration is quick, and the website is easy to navigate. myStrength is secure and confidential. Register at: https://bh.mystrength.com/ beaconcovidsupport.

Questions and additional resources

• Questions or concerns regarding your Empire Plan benefits can be addressed by calling The Empire Plan toll free at 1-877-769-7447 and select the option for the appropriate program.

• Option 1; Empire Plan Medical Program (United HealthCare)

• Option 2; Empire Plan Hospital Program (Empire BlueCross)

• Option 3; Empire Plan MH/SA Program (Beacon Health)

• Option 4; Empire Plan Prescription Drug Program (CVS Caremark)

• Option 5; Empire Plan Nurseline (24/7 availability to answer health-related questions)

any remaining funds in their FSA account.

The new guidance allows employers to extend the grace period to the end of 2020. If adopted, employers can allow claims incurred in 2020 to be applied to remaining 2019 FSA balances.

IRS Notice 2020-33: Increased Flexible Spending Account (FSA) carryover cap

If an employer currently allows FSA monies to be carried over

for use in the following plan year, beginning in 2021, the $500 limit will be increased to $550.

IRS allows employer flexibility for health plans & FSAs

The IRS recently released two notices which, if allowed by the employer, would allow participants to make changes to their enrollments in employer-sponsored health plans or adjust pre-tax contributions to health flexible spending accounts (health FSAs) and dependent

care flexible spending accounts (dependent care FSAs).

Please note it is the employer’s sole discretion whether to implement these new IRS changes, which are not mandatory. Please contact your employer with any questions.

18 The Work Force

IRS Notice 2020-29: Health plan enrollment and elections

Employers, at their sole discretion, may allow employees to make changes to their health plan coverage. Changes can include:

• New enrollment in the employer-

sponsored health plan (even if an employee previously declined enrollment)

• Switching health plans or tiers (i.e. single coverage to family coverage) within plans

• Revoking an existing health coverage election; must attest in writing to other health coverage.

Flexible Spending Account (FSA) enrollment and elections

For health and dependent

care FSAs, employers can allow employees to enroll, drop coverage and increase/decrease payroll deducted contributions during 2020.

Flexible Spending Account (FSA) use-it-or-lose-it rules

Current IRS rules allow employers (again, sole discretion of the employer to allow) to add a two- and-a-half-month grace period immediately following the end

of each FSA plan year during which employees could spend

Mental Health and Substance Abuse Program

• myStrength Online Emotional

Health Program. Empire Plan enrollees and dependents are reminded that Beacon Health

is offering free access to their myStrength COVID-19 website and app content. Beacon Health’s myStrength has an extensive library of articles, videos, and eLearning programs that are aimed at helping members navigate new COVID-19 challenges such as heightened levels of stress and/or anxiety, feelings of isolation, and other challenges currently being faced.

July-August 2020