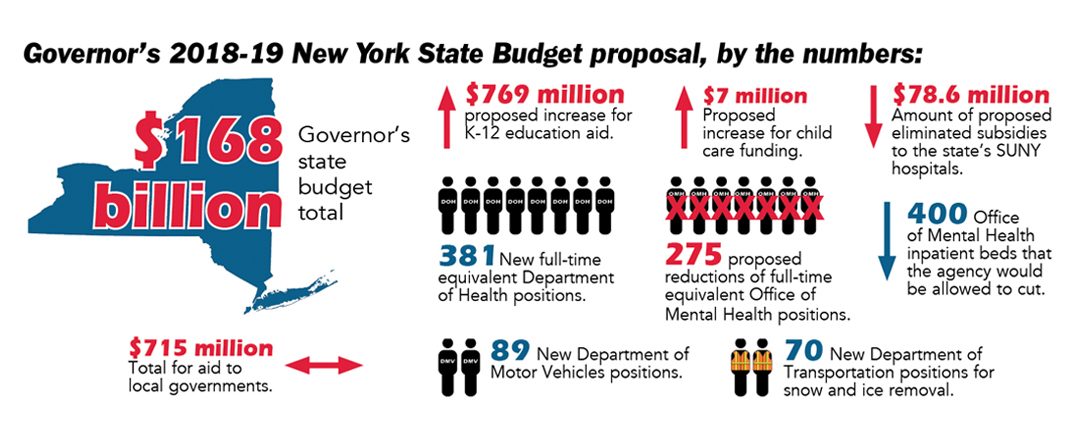

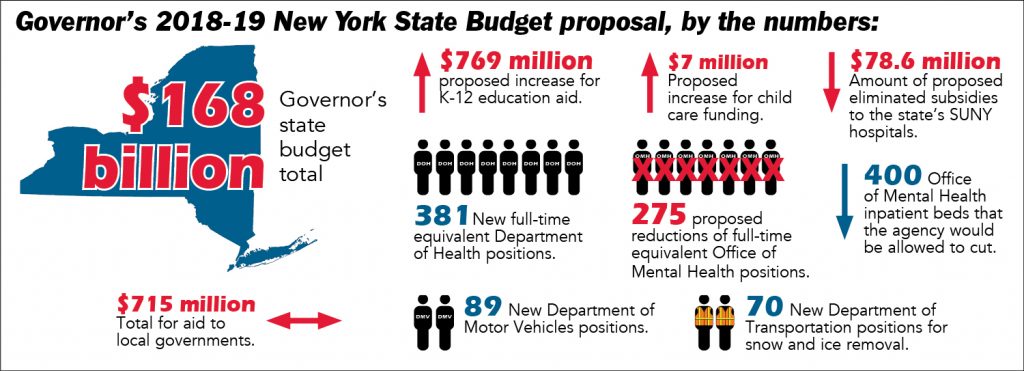

ALBANY — Gov. Andrew Cuomo’s proposed $168 billion 2018-19 New York State Budget includes proposals that will help the state weather uncertain support from the federal government, but fails to go far enough to protect all New Yorkers.

A major aspect driving the state budget is the effect of federal tax reform on New York, and the expected cuts to federal programs such as Medicare and Medicaid to help pay for the tax cuts. The new tax law also caps the deductibility of state and local taxes for many New Yorkers.

The proposed state budget contains $1 billion in new revenue to help close the $4 billion budget deficit, including a sales tax on internet purchases (with a portion of this tax going to local governments), taxes on opiates (with revenues going to fight the opioid epidemic), vaping liquid and health insurers.

The revenues will offset additional cuts to state agencies and local government aid, both of which were essentially held flat under the governor’s plan.

“The governor’s revenue proposals are a step in the right direction,” CSEA President Danny Donohue said. “The revenues are a smart way to help balance the budget and protect public services from devastating funding cuts.

State agencies and local governments have been doing more with less every year, and more cuts would mean more harm to the New Yorkers who need these services the most.”

These New Yorkers include many indigent, poor and uninsured people who receive health care at one at the state’s three safety-net, State University of New York (SUNY) hospitals. The budget includes eliminating the $78.6 million subsidy to the SUNY hospitals and instead provides the same level of capital funding to the facilities.

This shift would endanger the hospitals’ ability to continue to provide health care to all who need services. We will work to get the subsidies restored.

“It is unconscionable that the state would walk away from its responsibility to provide funding for a major public provider of health care,” Donohue said. “The people these hospitals serve need our help the most.”

We are also strongly concerned about the state’s proposals for mental health care and juvenile justice.

In the state Office of Mental Health (OHM), the budget cuts 275 full-time equivalent positions through attrition and allows the reduction of up to 400 state-operated inpatient beds.

“Eliminating direct care staff and reducing the capacity for mental health facilities to care for those with mental illness makes it harder for them to receive services,” Donohue said.

The budget also proposes closing the state Office of Children and Family Services’ (OCFS) Ella McQueen Reception Center in Brooklyn with only 30 days notice instead of the required one-year notification.

The center, which serves as a port of entry for youths headed to non-secure and limited secure OCFS facilities, provides testing and other critical services needed to provide youths with the services they need. We oppose the closure, as well as the 30-day notice.

As The Work Force went to press, CSEA was providing testimony to state lawmakers about the budget proposal.

“This is a tough budget year and we credit the state for looking at solutions other than further cuts to already-stretched public services, but there is much work to be done,” Donohue said. “We will work to ensure that this state budget is fair for everyone.”