Gov. Kathy Hochul, in her recent State of the State address, is prioritizing affordability for New Yorkers.

In her January 14 State of the State address, the governor focused on making New York more affordable, particularly as many people are still struggling coming out the pandemic, and facing high inflation.

Among Hochul’s proposals are lowering income taxes for middle-class families, providing inflation rebate checks and increasing the child tax credit.

The governor also proposed to extend the NY HELPS program for an additional year. Hochul will also propose to better protect highway workers by making permanent the use of work zone speed cameras on the New York State Thruway and on highways maintained by the state Department of Transportation.

CSEA President Mary E. Sullivan applauded Governor Hochul for her commitment to working people.

“Her focus on affordability for middle class families is just what our state needs to bounce back from record inflation.” Said Sullivan. “Her attention to our state’s safety and security is a major step toward making our communities safer.”

As this edition went to press, the governor also had released her proposed New York State Budget. Below are some of the main takeaways from the proposed budget; our union is reviewing the budget details. See cseany.org for more information as it becomes available. The final budget is due April 1.

CSEA will testify before the State Legislature’s Workforce Development and Labor budget committee hearing as part of the budget process.

“On behalf of all CSEA members, we look forward to working with the governor and the state legislature to move New York forward,” said Sullivan.

Key details of the proposed New York State Budget

Key details of the proposed New York State Budget

Tax Relief: The Governor proposes tax cuts for individuals earning up to $323,200 annually.

Inflation Rebate Checks: Provide New Yorkers with $3 billion in Inflation Rebate Checks. Joint filers making less than $300,000 – $500. Single filers making less than $150,000 – $300.

Expanded Child Tax Credit: The budget increases the child tax credit to $1,000 for children aged 0-4 and $500 for children aged 4-16.

Civil Service Exam Fees: The Governor proposes waiving state civil service exam fees through June 2026.

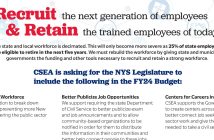

NY HELP Program: The Governor also proposes extending the NY HELP program through June 2026, providing continued support for the state and local governments still struggling to recruit staff.

State Operated Inpatient Forensic Treatment Beds: The budget includes funding for 100 new state operated inpatient forensic treatment beds in New York City to address critical needs in mental health services.

Work Zone Safety: On the safety front, the Governor proposes making the work zone speed camera program permanent and increasing penalties for violators who receive multiple tickets within 18 months.

Assault Penalties: The budget also proposes elevating the penalty for assaulting DMV examiners, motor vehicle representatives, and highway workers (employed by state, public authorities, and local governments) from a Class A misdemeanor to a Class D felony.

SUNY Funding: The Governor proposes new funding of $450 million for SUNY Downstate Medical to transform and modernize it and $200 million for SUNY Upstate Medical to build a new emergency department.

Local and School Funding: The budget includes an additional $50 million in state aid for local governments and a $1.7 billion increase in funding for K-12 school districts.