Working people recently got an unwelcome holiday gift in the form of new federal tax legislation that will allow corporate interests and the wealthy to further rig the rules, while taking money — and essential services — from working people.

Working people recently got an unwelcome holiday gift in the form of new federal tax legislation that will allow corporate interests and the wealthy to further rig the rules, while taking money — and essential services — from working people.

As this edition went to press, the House and Senate had approved the bill, which was on its way to President Donald Trump, who is expected to sign it into law.

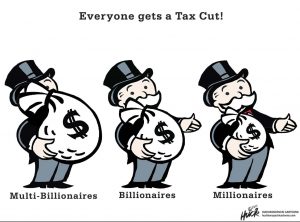

The bill provides tax cuts to corporations and the wealthy, at the expense of working people and retirees.

Here are some features of the final legislation, with numbers partially provided by the AFL-CIO:

- Cuts the corporate tax rate from 35 percent to 21 percent without eliminating tax loopholes that allow corporations to pay far less than the statutory rate. What does this mean? Big banks, hedge funds and other Wall Street firms are the biggest winners. The richest 1 percent of households would receive 83 percent of tax cuts, and the richest 0.1 percent would get an average tax cut of more than $148,000. All cuts to corporate tax rates are permanent.

- While elected officials tout this program as a “tax cut for working people,” this plan will eventually take money out of our wallets. Tax cuts to most individual taxpayers will expire in 2025. About 70 million households making less than $100,000 would eventually pay more.

- Caps state and local property, income and sales tax deductions combined at $10,000, and fewer taxpayers will itemize deductions. This will cause millions of taxpayers to pay higher taxes. In New York, this is a particularly strong concern, as many taxpayers here will likely see a tax increase.

- Limits on deductions will also increase pressure on state and local governments to cut programs and services, including essential public services, to lower taxes. The tax constraints will likely lead to more challenges in spending for public services, including health care, education, social services and more. Undermining these services would harm millions of people in New York.

- Doubles the amount that is exempt from the estate tax.

- Repeals the Affordable Care Act’s “individual mandate” that all Americans have health care or pay a penalty. Because of this repeal, health care premiums in the individual market would rise by 10 percent, 13 million people would lose health insurance, and as many as 15,000 or more people face potential risks to their lives for being unable to access affordable health care.

- Adds $1.5 trillion to the federal deficit over 10 years. To help pay for the costs of this plan, House Speaker Paul Ryan has stated that next year he will pursue legislation to cut funding for programs such as Medicaid, Medicare and other programs that fund the jobs of CSEA members throughout New York state.

This tax legislation will harm working people and retirees for generations to come.

“Corporate CEOs and the wealthy will become even richer through this tax giveaway, while working people will find it even harder to take care of their families,” CSEA President Danny Donohue said. “Even more so, this tax plan jeopardizes many of our essential public services that so many New Yorkers rely upon every day. The money that the wealthy will receive through tax breaks would be much better used for infrastructure, schools, health care and many more services that would help all people.”

The quikest and easiest way to stay up-to-date on what is happening in Albany and Washington is “This Week in Albany.” Sign up for “This Week in Albany” email alerts: cseany.org/SignUpTWIA